Let’s be honest: when you’re starting ( or buying) a business, you don’t wake up thinking, “ah yes, can’t wait to hit zero today.” You want profit. Growth. An impressive bank account. So the break-even point — that moment where revenue exactly covers costs — often gets ignored. It sounds boring, like financial broccoli.

But here’s the twist: if you truly understand break-even, you can buy an Offiro store and pay less than 10% of its price out of pocket to get started. Sounds a bit bold? I know. If you’re curious — and you should be — read on.

In this guide, we’ll talk through the break-even point, show you the exact numbers to watch, and yes, we’ll connect it to a simple, practical approach that helps you step into ownership without draining your savings.

The Real Numbers Behind the Magic

Let’s make this practical. You’ve just found a store on Offiro that looks way too good to scroll past — Globaq.com. It’s a fully operational, profitable online store already stocked with 2025’s top-selling products across several trending niches.

Now, let’s imagine the asking price is $16,800, and you decide to take the 12-installment plan. That means you’ll pay $1,400 upfront, and then the same amount 11 more times. Each payment is fixed so no surprises and no extra fees. That $1,400 is what we’ll call your fixed cost for each period.

So here’s the challenge:

How do you make sure the store earns enough to cover every one of those installments by itself, so you’re not paying out of your own pocket each month?

Let’s peek under the hood.

You start browsing your new store and notice one of your top sellers — a sleek camping titanium dinner lunch box set. People love it. You sell it for $100 a piece, and it flies off the digital shelves.

Now, it might be tempting to think: “Alright, $1,400 divided by $100 — I just need 14 orders a month, easy.” But that’s not the whole story. Because behind that $100 sale, there are costs you have to cover before you get to keep anything.

Every time someone buys a lunch box, you pay your supplier for the product itself and for its delivery. That’s the beauty of dropshipping. Let’s say that together, the product and shipping cost you $60 per order.

That $60 is what we call your variable cost — it changes depending on how many sales you make. If you don’t sell, you don’t pay.

Now we take that $100 selling price, subtract the $60 cost, and end up with $40.

That $40 is your contribution margin — your actual income per order.

In simple terms, every sale “contributes” $40 toward paying your fixed costs (your Offiro installment). Once you’ve covered it, everything else goes directly to your wallet.

So, how many of these contributions do you need to cover your $1,400 monthly installment?

That’s exactly what we’ll figure out next.

The Simple Math That Shows When You’re in the Clear

Alright, time to make numbers work.

We already know two things:

- Your fixed cost — that $1,400 monthly installment you pay for your Offiro store

- Your contribution margin — $40 profit from each camping titanium lunch box set you sell after covering the supplier and shipping costs

Now, here’s the question: how many lunch boxes do we need to sell so that the store pays for itself?

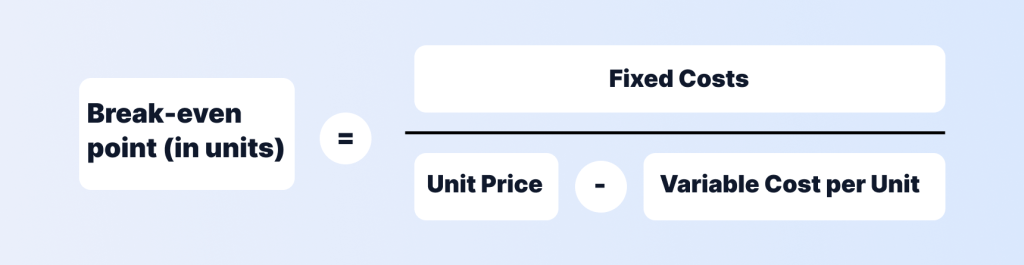

To figure that out, we need a simple formula. It’s as straightforward as dividing your expenses by your profit per sale.

Here’s how it works:

To cover your $1,400, you divide it by what we called the contribution margin — your product ( or unit) price minus all the expenses you take to buy it and get it delivered.

In our case:

That’s it.

You need to sell 35 lunch boxes to fully cover your $1,400 installment.

Sell 35? You’ve broken even — you didn’t lose a cent, and your store basically “paid its own bill.”

Sell anything above that? Congratulations, that’s profit and it’s yours to keep.

That’s exactly what we’ll figure out next.

Counting in Dollars, Not Just Boxes

So, calculating your break-even point in units is nice and simple.

But let’s be real: no store sells just one product. Even if that lunch box set is your star performer, there are always other items bringing in sales too.

That’s why, in practice, it’s much more useful to think about your break-even point in monetary terms: not just how many items you sell, but how much money your store needs to make to cover all your costs and how to do it the smart way.

Let’s make our example a bit more realistic.

Alongside your trusty lunch boxes, your store also sells a 22” portable outdoor propane fire pit — a crowd favorite among campers. It’s priced at $890.

When an order comes in, here’s what happens behind the scenes:

- You pay $600 to your supplier for the product itself

- You pay another $70 for delivery — it’s on the heavier side, so fair enough.

And now you’ve decided to ramp up your visibility using Offiro’s marketing services, which add another $200 to your fixed monthly costs.

So now your total fixed cost isn’t $1,400 anymore — it’s $1,600.

How do we break even now?

Here’s where it gets practical.

You open your Offiro Dashboard and check your average monthly sales. Turns out, your lunch boxes are still doing well: around 30 orders a month.

Each one gives you a $40 contribution margin, which adds up to:

30 × 40 = 1,200

That’s $1,200, but your new fixed costs are $1,600, so you’re $400 short of breaking even.

Now here’s where the fire pits come in.

Each of them gives you:

890 − 600 − 70 = 220

That’s $220 of profit per unit.

Sell just two of them, and you’ve made $440, pushing your total profit to $1,640 — enough to break even and even pocket a little extra.

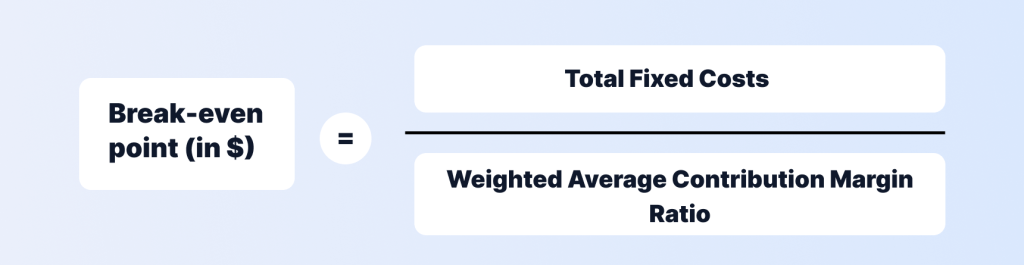

So if we wanted to express this idea in a formula, it would look like this:

To find your break-even point in money, you divide your total fixed costs by your average profit per sale across all products — or, if you sell multiple items, you can weigh them by their contribution to overall profit.

In short:

Basically it just means your store breaks even when the money coming in from all your products equals your fixed expenses.

Whether it’s from 35 lunch boxes, two fire pits, or a mix of both, your goal is to balance the math so that your store covers itself.

Which means you’re growing your income while only spending less than 10% of the store’s cost from your own pocket.

Now that’s smart scaling.

How Knowing Your Break-Even Point Changes The Game

We’ve established that your break-even point is a reflection of how healthy your business is and how much room you have to grow.

Once you get comfortable with it, you’ll realize it’s less about hitting zero and more about learning how to control your profit.

Let’s keep working with our story and see what understanding your BEP really lets you do.

1. Adjust pricing and offers intelligently

Since you added marketing services, your fixed cost went up to $1,600. That’s what you need to cover every month to stay in the clear.

Now, you might get the idea to run a discount: drop your lunch box price from $100 to $90 for a short campaign.

At first glance, it feels like you’re losing money per sale and you kind of are: your contribution margin goes from $40 to $30. That means, mathematically, you’d need to sell 54 units instead of 35 to reach $1,600.

But here’s the twist: discounts can also boost volume.

Let’s say your Offiro ads bring you 40% more sales during that promo. Instead of 35 boxes, you sell 49.

Now your total contribution becomes 49 × 30 = $1,470 — still just shy of break-even, but remember those two fire pits you sold last month? They bring in $220 × 2 = $440, pushing your total to $1,910.

So you didn’t lose money and instead you made $310 profit, while building brand awareness and getting new repeat customers.

That’s the difference between guessing and knowing. BEP lets you see exactly where your promo campaigns turn from risk into reward.

2. Set achievable growth milestones

You’re paying for your store in installments still, but here’s the thing: your store is paying those installments for you.

You can use Offiro’s marketing services to plan your next growth jump strategically:

- This month, your target is 35 lunch boxes and two fire pits to hit BEP

- Next month, with optimized ads, your goal might be 45 lunch boxes and three fire pits — that’s around $2,670 in total margin, which comfortably covers your $1,600 cost and leaves you $1,000+ ahead.

And since your installment plan spreads the cost evenly, you can keep scaling without financial pressure. This is what makes Offiro’s system so powerful for new entrepreneurs: you can literally plan your growth while your store pays for itself.

3. See how expanding your product line affects profitability

Now, let’s say you decide to expand not just more physical products, but a whole new type of offer: digital goods.

You launch “Purposeful Progress: How to Set Goals with Kaizen & Ikigai” — a short, downloadable guide for people who want a more mindful lifestyle.

Digital products usually have no variable costs once created. You pay nothing per sale — it’s pure margin.

If you sell just 20 copies a month at $25 each, that’s $500 extra income and every cent of that goes straight into profit.

Suddenly, your BEP drops dramatically because part of your income doesn’t rely on shipping or suppliers anymore. That’s how expanding wisely can change the math in your favor.

4. Spot which costs can be optimized without hurting performance

Your Offiro marketing plan is doing great, but now you’ve gathered enough data to test what happens if you slightly adjust your ad spend.

You reduce your marketing budget from $200 to $150 while keeping your campaigns efficient.

With that your monthly fixed cost drops from $1,600 to $1,550.

That’s one less lunch box you need to sell to break even.

Tiny changes like that, repeated over time, quietly compound into real savings, but they never show up unless you’re tracking your BEP.

5. Prevent overspending before it snowballs

It’s easy to get excited when your sales start growing. You start stacking on new apps, more ad channels, maybe a design revamp. Suddenly your monthly costs creep up to $2,000.

But with BEP tracking, you’ll see the danger early.

Instead of realizing two months later that you’re earning less profit, you’ll notice right away that your store now needs to sell 50+ lunch boxes just to break even.

That’s your cue to slow down and focus on what’s actually working.

6. Reveal inefficient pricing early

Imagine your supplier raises prices — the fire pit now costs $650 instead of $600.

Your margin drops from $220 to $170 per unit, meaning you now need to sell three fire pits instead of two just to break even.

If you weren’t watching your BEP, this would slip by quietly until your profit starts disappearing. But because you’re tracking it, you’ll see it right away — and you can react by negotiating with suppliers, adjusting your price to $920, or running bundle deals that recover the lost margin.

7. Adjust strategy early when sales dip

Let’s say it’s a slow season: camping gear sales cool off, and your lunch box sales fall from 30 to 20 per month.

Instead of panicking, you check your dashboard. You know your BEP, your margins, and your sales patterns. You quickly see that if you sell just one extra fire pit and ten digital guides, you’ll still land above break-even.

Crisis averted and your confidence stays intact.

So, How Do You Buy an Offiro Store by Paying Less Than 10%?

Now that you’ve seen how break-even really works, the “10% trick” probably makes a lot more sense, right? It’s just smart business math combined with the way Offiro’s installment system is built.

Here’s the simple version: when you buy an Offiro store, you pay less than 10% upfront — that’s your first installment. The rest can be covered entirely by your store’s own earnings, as long as you understand your break-even point and keep your sales consistent.

In other words, your store literally pays for itself.

By the time you’ve finished your final payment, you haven’t just “bought a store” — you’ve earned it through smart, controlled growth.

And if you’re still unsure, Offiro’s free trial lets you see it all for yourself. You’ll watch your store in action. You’ll know your costs, your margins, and your break-even point before you ever commit.