Remember when owning your own business felt like something that required a massive bank account or a nerve-wracking loan? Those days are behind us. At Offiro, we’ve redesigned how people step into eCommerce ownership — and it starts with making the financial side actually make sense.

Here’s something interesting: you can start running a profitable online store today and pay for it gradually while it’s already generating income. It’s not a layaway plan where you wait to receive something. You get full access, keep the profits, and spread the purchase cost over time. Let’s break down exactly how this works and why it might be the smartest way to start your eCommerce journey.

The Traditional Business Buying Problem ( And How We Solved It)

Traditionally, buying an established business required covering a significant portion of the purchase price upfront. Even with proper due diligence and full access to financials, buyers were often expected to commit $10,000 or more on day one — before they had the chance to actually run the business.

This created an impossible situation: the people with the most passion and drive often couldn’t access the capital, while those with the capital sometimes lacked the time or interest to grow the business. We looked at this backwards system and asked a simple question: what if the business could essentially pay for itself?

How Offiro’s Trial-to-Installment Model Actually Works

Your 14-Day Discovery Period

Every Offiro store comes with a two-week trial period. While certain core settings remain locked for security, you still get real access to the business: see live orders, work with the dashboard, explore the marketing systems, and get a clear sense of what it feels like to run this store.

During these 14 days, you’re running the business. The profits are yours. You’re not just window shopping — you’re test-driving with the keys in your hand and the tank full.

Our flexible trial model removes traditional barriers to business ownership, allowing you to experience the store firsthand before committing to purchase.

The Seamless Transition to Ownership

Here’s where it gets really practical. If you love the store and want to continue ( and most people do), your purchase transitions to a ten-payment plan when the trial ends. No paperwork hassle, no reapplying, no awkward conversations.

Payments are structured with flexibility in mind. In many cases, you can apply store-generated funds toward your installments, making it easier to manage monthly obligations.

Understanding the Payment Schedule

Ten payments spread over ten months means you’re making manageable monthly payments while the business continues operating and generating revenue. Think about that for a moment — you’re paying for the business with one hand while collecting profits with the other.

If a store costs $10,000, you’re looking at roughly $1,000 monthly payments. But if that store generates $2,500 monthly profit, you’re actually cash-flow positive from month one. The business isn’t just paying for itself — it’s paying you too.

Advertising costs and specific billing details appear clearly during checkout and may vary by store, so you’ll always know exactly what to expect.

The Math That Makes Sense

Let’s walk through a real example with one of our mid-range stores:

Store details:

- Purchase price: $10,900

- Monthly profit: $2,568

- Monthly payment: $1,090

Your monthly reality:

- Store generates: $2,568

- Payment costs: $1,090

- Your actual profit: $1,478

You’re making nearly $1,500 monthly while acquiring a business asset. After ten months, you own the business outright and that full $2,568 monthly profit is entirely yours. Over those ten months, you’ve made roughly $14,780 in profit while paying $10,900 for the business.

The business literally pays for itself and puts money in your pocket simultaneously.

Why This Changes Everything for New Entrepreneurs

Accessibility Without Compromise

Traditional business financing required good credit, business plans, collateral, and often months of waiting. Our installment approach needs none of that. You qualify by choosing a store and starting your trial.

This isn’t about lowering standards — it’s about removing arbitrary barriers that had nothing to do with your ability to run a successful eCommerce store.

Learning While Earning

The trial period means you’re not making a blind commitment. You understand the business before the payments even begin. By the time your first payment processes, you’ve already run the store for two weeks and know exactly what you’re buying.

This hands- on experience is invaluable. You’re not learning theory — you’re learning your actual business with real customers and real transactions.

Offiro’s approach lets you test our established store service with minimal upfront investment while spreading the remaining cost over manageable payments.

Cash Flow From Day One

Perhaps the biggest advantage is maintaining positive cash flow from the start. You’re never in a position where you’ve invested heavily and are waiting months to see returns. The returns begin immediately because you’re buying a business that’s already working.

This positive cash flow creates breathing room. You’re not stressed about covering the payment because the business is generating more than enough to handle it.

The Details That Matter

When do payments start?

Your first payment processes when the 14-day trial ends. This gives you two full weeks to operate the business and understand its rhythms before any purchase commitment begins.

How payment processing works

We charge your credit card for each monthly payment.Each monthly payment is handled securely, and in many cases you can direct store-generated funds toward your installments, giving you more control over cash flow.

Advertising and operating costs

Each store has its own advertising costs and operational expenses. These details are clearly displayed during checkout, so you know exactly what the store requires to maintain its current performance level. These ongoing costs are separate from your installment payments — they’re the normal operating expenses of running the business.

Why Sellers Love This Model Too

This isn’t just beneficial for buyers. Sellers gain access to a much larger pool of serious, qualified buyers. Instead of waiting months to find someone with $15,000 sitting in their bank account, they can connect with ambitious entrepreneurs who will actually grow the business.

Our vetting process ensures buyers are serious and capable. Sellers don’t worry about payment reliability because Offiro handles the transaction security. It’s the best of both worlds — faster sales and confident transactions.

Real-World Success Story

Consider Sarah, who started with our $8,000 eco-friendly home goods store. Her monthly payments were $800, but the store generated $2,300 monthly profit.

Over the ten-month payment period, she made roughly $23,000 in profit while paying $8,000 for the business — a $15,000 net gain. After completing payments, she owned the business outright and started keeping the full monthly profit.

More importantly, those ten months gave her time to deeply understand the business, optimize operations, and build confidence. By month six, she’d increased monthly profits to $3,200 through small improvements to the product mix and marketing.

She didn’t just buy a business — she grew into an eCommerce entrepreneur while the business funded both its own purchase and her learning curve.

Getting Started

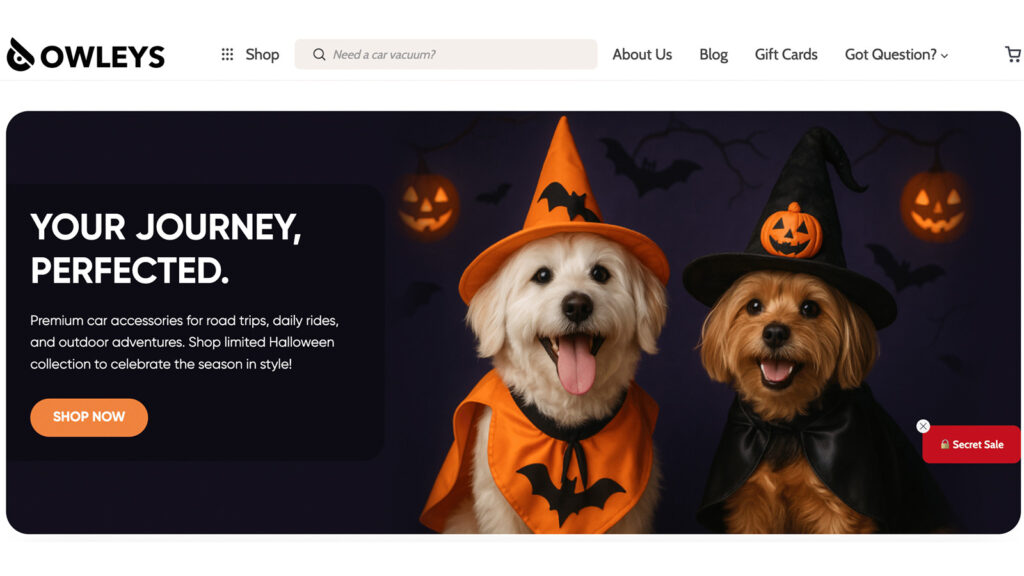

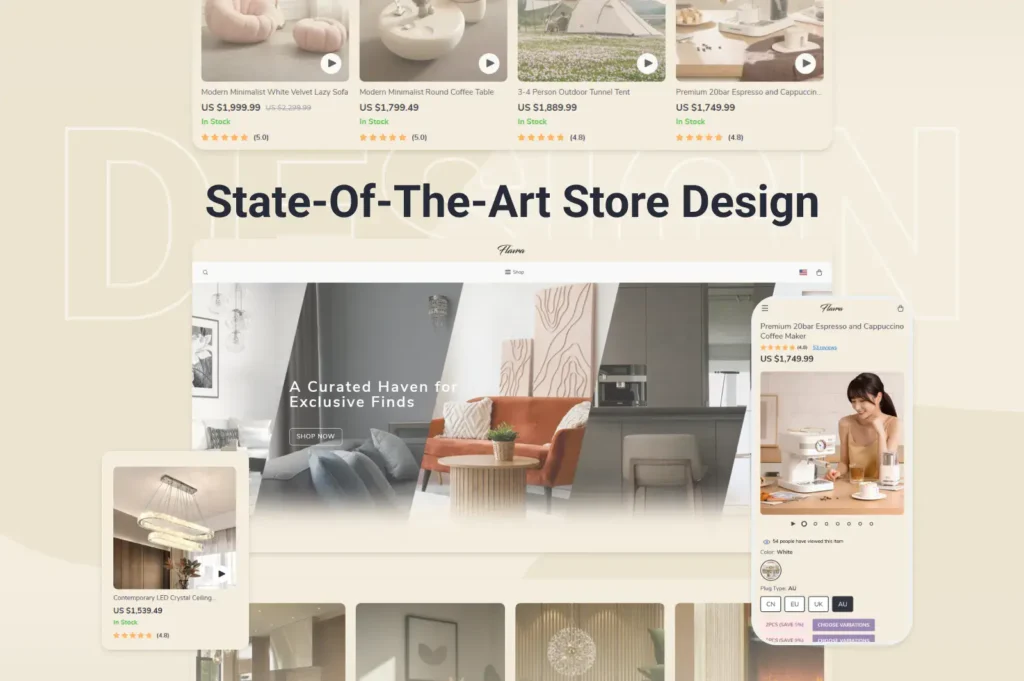

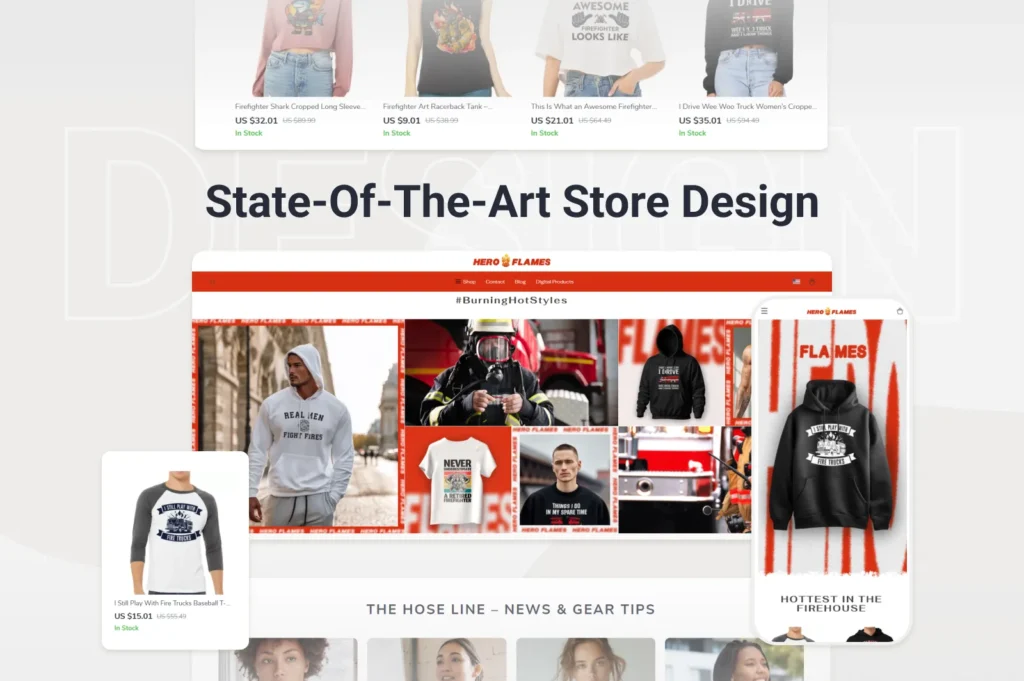

Browse our verified listings of established eCommerce stores. Each listing clearly shows the purchase price, monthly profit, and payment structure. You’ll see exactly what your monthly payment would be and what profit the store currently generates.

When you find a store that excites you, start your 14-day trial. Experience the business firsthand, see orders come in, understand the operations, and make your decision from a position of knowledge rather than hope.

If you love it, continue seamlessly into ownership with manageable monthly payments while keeping all the profits the business generates.

Your eCommerce Journey Starts Now

The question isn’t whether you can afford to buy an established eCommerce store — it’s whether you’re ready to start building your business today. The financial structure is designed to work in your favor, with the business essentially funding its own acquisition while putting money in your pocket.

Every successful eCommerce entrepreneur had to start somewhere. The difference is, you’re starting with a business that already works, customers who already buy, and a payment structure that makes actual financial sense.

Ready to explore our available stores? Browse our verified listings and start your 14-day trial today.

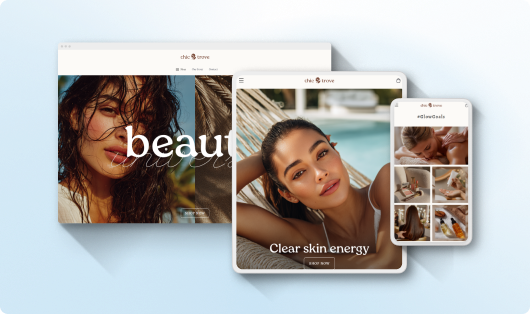

All Offiro stores are built on Sellvia’s reliable infrastructure, ensuring stable operations from day one.